Compound Interest and Dollar-Cost Averaging: Retiring on Your Own Terms

Compound Interest and Dollar-Cost Averaging: Retiring on Your Own Terms

Saving for retirement; it is a consistent enigma for the working class. It is important enough for participants to know they should be doing it, yet distant enough to seem insignificant in the present moment. In fact, it can even seem impossible at times, as countless industry professionals continue to tout 15% salary deferrals and $1 million retirement savings minimums.

Also, in this era of immediate gratification, there simply isn’t an immediate reward for saving for retirement. While a new TV or car can be enjoyed immediately, it can take decades for you to realize any semblance of a reward for your diligent 401(k) retirement contributions.

Maybe you don’t view retirement as a purchase in the same lens that you would view a new TV or car. Yet that is exactly what you do when you participate in a 401(k) plan; you are deferring money today to use as retirement income tomorrow. When you factor rising living costs due to inflation and the increasing lifespan of participants into the equation, it is easy to understand why participants feel pessimistic about their chances of retiring on their own terms.

However, thanks to compound interest and dollar-cost averaging, participants may help improve their retirement readiness and retire on their own terms by simply deferring a little bit all the time.

While compound interest and dollar-cost averaging can take decades to reveal their effects, they potentially have the power to turn small 401(k) contributions today into substantial 401(k) balances at retirement. You owe it to your future self to understand the importance of starting early and contributing consistently.

The 401(k) “Snowball” Effect

Albert Einstein is credited as saying “compound interest is the eighth wonder of the world.” Time and time again, we have seen participants become 401(k) millionaires with the help of compound interest.

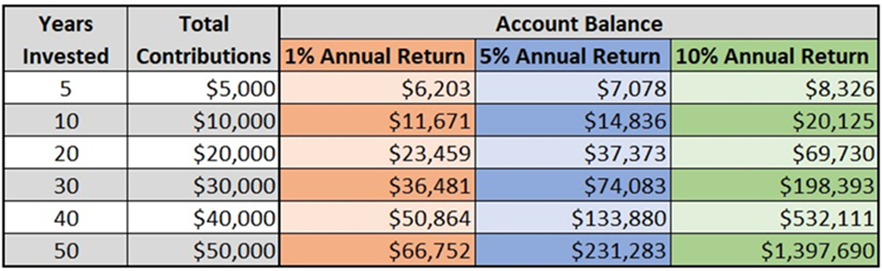

Compound interest simply refers to the additional interest earned on interest that has already been earned. When 401(k) contributions are invested, they earn investment earnings, or interest. These earnings then earn their own earnings. Once these earnings have been invested for decades, the earnings on the 401(k) contributions will begin to “snowball,” resulting in annual increases in the account’s value. As we like to say at Chairvolotti Financial, “it’s not about timing the market, it’s about time in the market.” We have included a table below to illustrate the “snowball” effect of compound interest regarding 401(k) contributions. We will assume a $1,000 annual 401(k) contribution.

This is a hypothetical example for illustrative purposes only.

Remove the Emotion from Investing

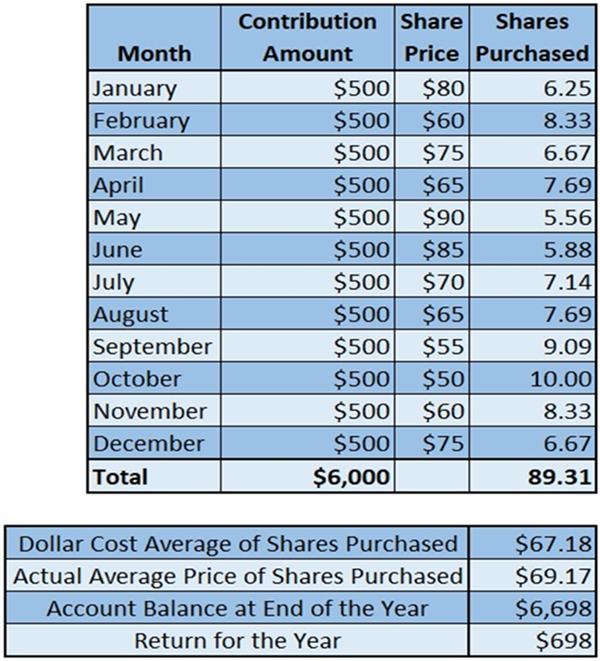

Dollar-cost averaging involves investing a fixed dollar amount on a consistent interval for an extended period of time. You may not realize it, but your 401(k) already employs the Dollar-cost averaging strategy every payroll. Since the share price of most securities fluctuates daily, your contributions buy a different number of shares each payroll. When shares are most expensive, you will buy fewer shares. When the shares have decreased in price, you will buy more of them. Over time, this strategy will decrease the average cost of shares your contributions have purchased.

Dollar-cost averaging allows participants to avoid the two most dangerous emotions of investing: fear and greed. When the stock market is down, investors become fearful and sell their investments while they are cheap, oftentimes missing out on the gains when the market recovers. In contrast, when the stock market is soaring, investors become greedy and rush in to purchase investments at or near their peak price, realizing very little (if any) gain. In 401(k), you are deferring a fixed amount of money into your elected investments, meaning that you will avoid investing too much during market peaks, and too little in market downturns.

While Dollar-cost averaging can be a difficult concept to explain, we have included a table to help illustrate this strategy. We will assume a $500 monthly 401(k) contribution. Note that in this example, even though the share price was lower in December than it was in January, the participant still saw a positive return for the year due to Dollar-cost averaging. The share prices are randomly created and unrelated to a real security.

This is a hypothetical example for illustrative purposes only.

Not Timing the Market, Time in the Market

Saving for retirement is one of the most important things participants must do during their working years. In the American Retirement System, you are 100% responsible for your own retirement. While Social Security will provide supplemental income in retirement, most of your pay check will have to be replaced by your 401(k) and other similar retirement savings. Yet, many workers don’t save for retirement at all because they believe their smaller contributions are pointless when considering the seemingly-insurmountable cost of retirement.

In reality, retirement is affordable to virtually anyone that makes regular 401(k) contributions. The savings process can take decades, and a small deferral amount today may seem trivial, but compound interest and dollar-cost averaging can help turn decades of small-but-consistent deferrals into an enviable nest egg at retirement. The sooner you start contributing a consistent amount to your retirement, the more time compound interest and dollar-cost averaging will have to work their magic.

For more information, check out 401(k) advisors

401Karat is a registered investment advisor. Information in this message is for the intended recipient[s] only. Please visit our Website for important disclosures.

Advisory services are offered through 401karat. Securities are offered through AdvisorAssist. 401karat and AdvisorAssist are not affiliated. Advisory services are only offered to clients or prospective clients where 401karat and its representatives are properly licensed or exempt from licensure.

Leave a Reply Cancel reply

- - ADVERTISEMENT - -

Categories

- Alumni Series (13)

- Automotive (57)

- Aviation (15)

- Business (14)

- Business & Arts (18)

- Career College Expositions (8)

- Career Development (96)

- CCC Blog (1)

- CCC Podcast (9)

- College Resource (90)

- College Showcase – Lincoln Tech (6)

- College Showcase – New Jersey (8)

- College Showcase – Pennco Tech (1)

- College Showcase – Universal Technical Institute (2)

- Continuing Education (155)

- Cosmetology (3)

- Counselor Resources (108)

- Criminal Justice (3)

- Dental Assistant (2)

- Education (110)

- Financial Literacy (17)

- Health Sciences (51)

- Heritage Series (3)

- High School Recruitment Series (4)

- Housing Series (10)

- HVAC (8)

- Imagine America Scholarships (12)

- Information Technology (17)

- Massage Therapy (5)

- Mechanical Sciences (109)

- Medical Assistant (12)

- Millennial Student Series (4)

- News (11)

- Nursing (22)

- Online education (13)

- Pandemic Proof Series (4)

- Personal Finance (17)

- Podcast (91)

- Research (11)

- Road Map Series (2)

- Scholarships (12)

- Social Media Series (4)

- Strata Tech (3)

- Student Success (29)

- Study Tips (3)

- Time Managment (1)

- Top 10 (10)

- Trucking (2)

- Uncategorized (14)

- Universal Technical Institute (19)

- Veteran Affairs (8)

- Welding (24)

- Women in Skilled Trades (3)

Tags

- - ADVERTISEMENT - -